Ew, taxes. Unfortunately, they’re part of your reality as a freelancer. And while taxes can be a bit daunting, don’t worry; we’ll break it all down for you.

Gather Everything You Need to File Your Taxes

First things first: make sure you have the following ready to go:

- EIN (Employer Identification Number): If you don’t have one, get one for free from the IRS.

- 1099 form from each client: Freelancers are considered independent contractors, so you’ll receive a form 1099 from each client that paid you over $600 in the previous tax year. Clients have until January 31 to send you a form 1099 (either via mail or electronically). If you don’t receive yours soon, reach out to the client ASAP for an ETA.

- Income earned by quarter: As a freelancer, you must submit an estimated tax payment each quarter to the IRS. You may also have to submit a quarterly tax payment to your state, depending on the state’s income tax requirements. Keep reading for the quarterly tax deadlines you need to know, plus how to calculate your quarterly estimated tax payments.

- Business operating expenses: Make sure these are tracked by category and calculated quarterly. Qualifying business expenses can be deducted from your quarterly estimated tax payments and annual personal income tax return. More on this later.

- Nice-to-haves:

- A dedicated business checking account

- A tax professional who specializes in taxes for self-employed individuals/freelancers

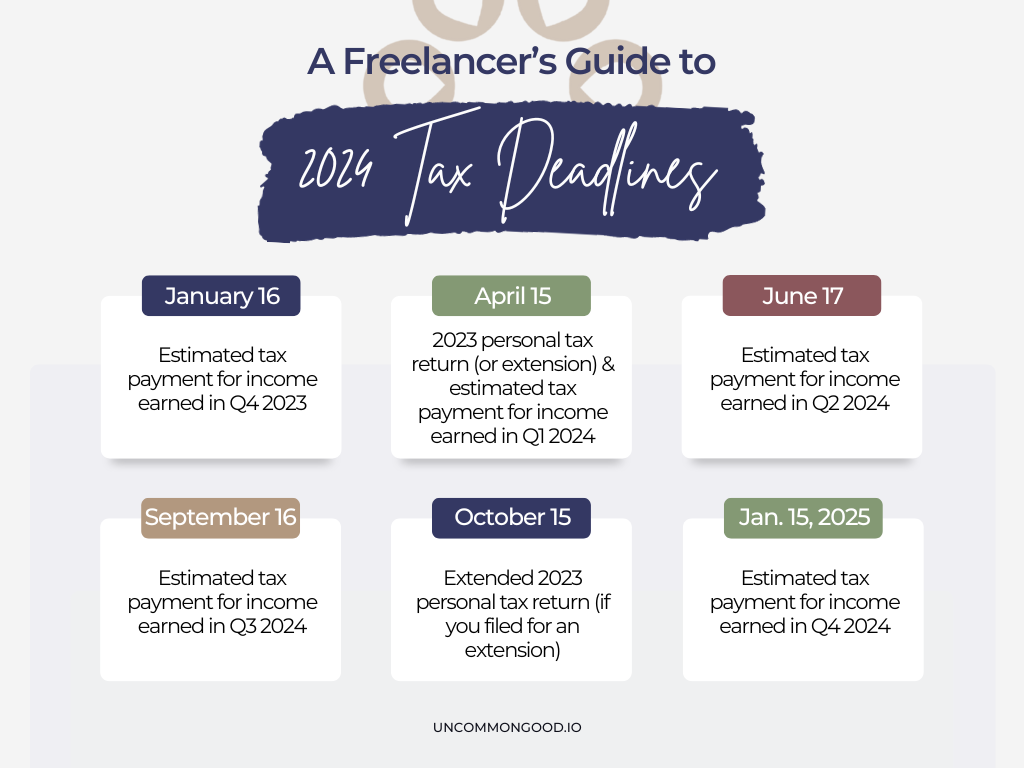

Know the 2024 Tax Deadlines for Freelancers

Quarterly estimated tax payments are due each January, April, June, and September. Yearly tax returns are due in April (regular filing deadline) or October (if you filed for an extension).

| Date | What to File |

| January 16, 2024 | Estimated tax payment for income earned in Q4 2023 |

| April 15, 2024 | 2023 personal tax return (or an extension) & quarterly estimated tax payment for income earned in Q1 2024 |

| June 17, 2024 | Estimated tax payment for income earned in Q2 2024 |

| September 16, 2024 | Estimated tax payment for income earned in Q3 2024 |

| October 15, 2024 | Extended 2023 personal tax return (if you filed for an extension) |

| January 15, 2025 | Estimated tax payment for income earned in Q4 2024 |

How to Calculate Your Quarterly Estimated Tax Payments

As a 1099 contractor, there are no taxes withheld from your income like a regular W-2 employee. This means you must pay the IRS every quarter an estimate of taxes based on the previous quarter’s income or else you will incur a fine.

To determine your quarterly tax payments, use the IRS form 1040-ES, either on paper or electronically via tax filing software. This will help you calculate how much you owe. Print out the payment vouchers, mail them with a check, or pay online.

TIP: Create an account with the IRS to track and schedule your quarterly estimated tax payments.

If you’re just starting and have no previous year’s freelancing income to base your estimate on, set aside around 30% of your income for taxes. It’s better to overpay than underpay because you’ll receive a refund come tax time.

How to Calculate Your Annual Taxes

Once you receive all of your 1099s from the previous year (remember: clients have until January 31 to send you a form 1099), it’s time to sit down and knock out your taxes. Gather your monthly expenses, any investment or dividend forms, retirement income forms (Form 5498 for IRAs), health insurance forms, and charitable donation records. For a general list, check this out. You should also report any income under $600 that you didn’t get a 1099 for as well as any foreign income, should you have any clients outside the U.S.

Tax Deductions for Freelancers

If you use an online software service like TurboTax, it’ll walk you through what you need but might not explain all of the tax deductions or credits a business owner can take advantage of. Here are some freelancer-specific tax deductions to consider:

- Internet plan costs (or a percentage if working from home)

- Cell phone plan cost (or a percentage if working from home)

- Software

- Home office (use 8829 form) or the cost of rent for your office

- Marketing

- Mileage (if you drive to a client’s office)

- Legal and professional services (you can hire a CPA and write it off)

- Meals (if you take a client to lunch; only 50% of the cost can be written off)

- Business insurance

- Professional certifications and licenses

- Educational courses

- Health insurance premiums

- Retirement plan contributions (SEP IRA)

- Student loan interest deduction

All but the last three items can be written off using Schedule C (Form 1040) for sole proprietors and SMLLCs. These are above-the-line deductions, which means you can take these costs and subtract them from your income to get your adjusted gross income (AGI). Once you’ve filled out all the necessary forms, you can e-file or mail in your tax returns (form 1040 + Schedule 1 and/or 2) to the U.S. government.

As always, consult with an accountant or tax professional if you have any questions.

Survive Tax Season with UncommonGood

UncommonGood is the all-in-one platform where freelancers manage their finances, marketing, and business operations. UncommonGood is the perfect tool for surviving tax season thanks to these features:

- Calendar: Never miss a tax filing deadline again! (That’s more of your hard-earned money that you get to keep.)

- To-Do List: Assign tasks and reminders to yourself to record your business operating expenses, submit estimated tax payments, and check in with your favorite tax professional.

- Invoices & Payments: Get paid via UncommonGood so you can track your income in one place.

Sign up for a free trial and discover the UncommonGood difference today!