Tax season is in full swing, with the first filing deadline already come and gone (January 16, for all you quarterly filers). You’re no doubt gathering the forms, receipts, and other paperwork needed to get your tax refund. But don’t forget to stay vigilant about protecting your personal information and hard-earned money, too. That’s because criminals are also busy using tax season as an opportunity to prey on unsuspecting individuals.

According to the IRS, fraudulent tax refunds cost Americans tens of millions of dollars each year. And that number is only climbing, especially in recent years thanks to COVID-related schemes and an increase in unemployment benefits fraud.

Tip: Bookmark the IRS’s Tax Scams/Consumer Alerts page and check it regularly to stay up to date on the latest alerts.

As a freelancer, you already wear multiple hats–don’t let being the victim of a scam be one of them. Here are some common tax scams to be aware of in 2024.

5 Tax Scams to Watch For

1. “Ghost” Tax Preparers

You’re swamped with *gestures broadly* life stuff, and tax forms look like hieroglyphics. Enter the “expert” tax preparer. They promise big refunds and ask for payment upfront. But once you hand over your personal information and payment, they disappear–poof!–like a ghost. Phantom tax preparers may also file a fraudulent return in your name but steal your tax refund.

Reputable tax preparers don’t vanish with your money or sensitive information. Always check credentials and references before you trust someone with your taxes, and make sure they sign the return and include their Preparer Tax Identification Number (PTIN).

2. IRS Imposters

Criminals often pose as IRS agents, legitimate tax services, or other tax professionals in an attempt to scare unsuspecting individuals into paying them money, providing personal information, or getting you to click a link that installs malware on your computer or mobile device.

Another imposter scam involves criminals filing a fraudulent tax return in your name, then calling you pretending to be the IRS. They claim there’s been an error and ask you to return your refund.

These bad actors use email, phone calls, and text messages to reach their victims. The IRS will never email, message, or call you with threats or demands for payment. Report imposters to the IRS immediately:

- Reporting scam emails: Forward the email to phishing@irs.gov.

- Reporting scam text messages: Forward text messages to 202-552-1226. Follow up with another text message containing the number that sent you the scam text message.

3. Identity Theft

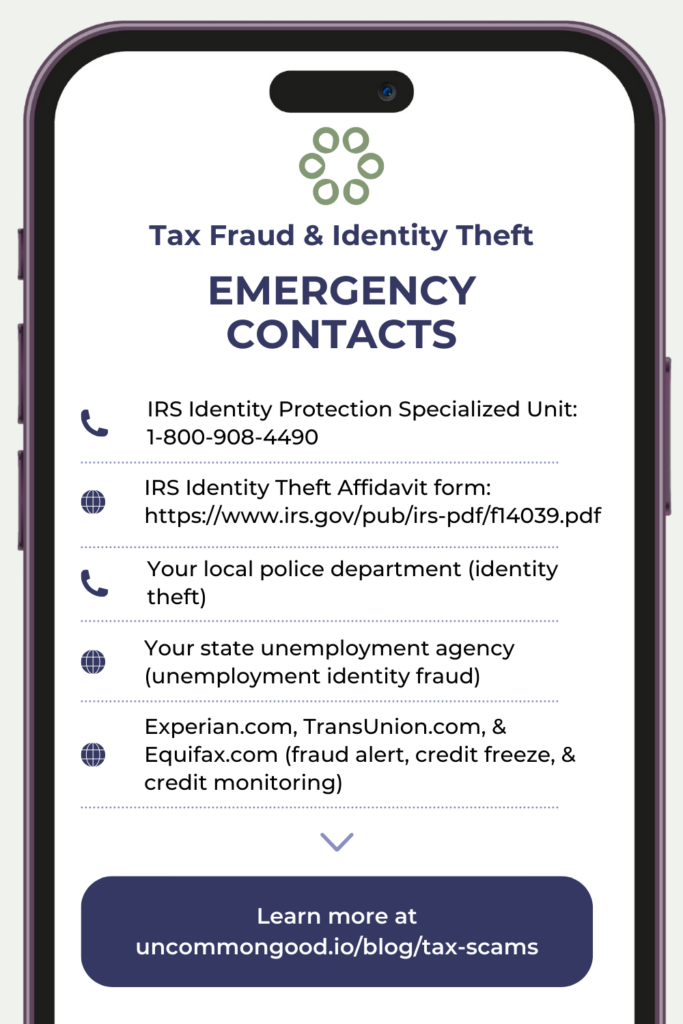

This one’s particularly insidious. Scammers might use your stolen Social Security number to file a fraudulent tax return in your name and snatch your refund. Protect your Social Security number like a treasure. If your tax return is rejected because one has already been filed with your SSN, report it to the IRS Identity Protection Specialized Unit (1-800-908-4490).

4. Unemployment Benefits Fraud

Another identity theft scam involves criminals filing fraudulent claims for unemployment compensation. Unemployment benefits are taxable income, so if you believe your identity was used to claim unemployment benefits, report it immediately to your state’s unemployment agency.

Tip: Filing your tax return early is the best way to ensure fraudsters don’t get to it first.

4. Fake Charities

You want to give back, and scammers know it. These bad actors set up fake charities, especially around tax season, hoping you’ll donate and claim a deduction. Do your research to ensure your money is going to a legitimate charity. Use tools like the IRS’s Tax Exempt Organization Search to verify that an organization is legit.

5. Unusual Payment Demands

Beware of scammers who claim you owe extra money to the IRS and insist on unconventional payment methods, such as gift cards or cryptocurrency. If you’re unsure, call the IRS directly to verify whether you owe additional money.

How to Know If You’re the Victim of a Tax Scam or Tax Fraud

Here are some red flags to look out for that could mean you’re the victim of a tax refund scam or fraud:

- You receive mysterious tax documents: If you receive tax documents (like a W-2 or 1099) from an employer you don’t recognize, someone may have used your personal information to secure employment.

- The IRS notifies you about unexplained income: The IRS might send you a notice via mail saying they’ve received information about income from an unknown source in your name. This could mean someone else is using your identity to work or commit fraud.

- You receive a surprise tax refund: You receive a tax refund you didn’t expect, or it’s significantly different from what you calculated. While it might be tempting to think it’s your lucky day, it’s more likely a sign of fraud.

- Your e-file is rejected: It’s one of the earliest signs of tax-related identity theft: your e-file is rejected because a return with your Social Security number has already been filed.

- The IRS notifies you about a suspicious tax return: If the IRS contacts you (via a letter, not email or phone call) about a suspicious tax return filed in your name, take it seriously. This is a clear indication that someone may be misusing your personal information.

- Unexpected changes to your IRS online account: If you notice unexpected changes to your IRS online account, or if you receive emails from the IRS about creating an account when you didn’t, someone else might be accessing your information.

- You’re denied credit unexpectedly: While not directly related to taxes, being unexpectedly denied credit can be a sign of broader identity theft, which can include tax-related fraud.

What to Do if You Suspect Tax Fraud or Identity Theft

Tax fraud can be a frightening and confusing experience, but by staying informed and taking swift action, you can mitigate the damage and protect your identity. Here are the steps to take if you suspect you’re a victim of tax fraud:

- Contact the IRS Identity Protection Specialized Unit at 1-800-908-4490

- Submit an IRS Identity Theft Affidavit (Form 14039) to report that someone may have used your identity in a fraudulent way

- File a report with your local police if you suspect identity theft

- Set up a fraud alert or credit freeze with each credit bureau

- Check your credit reports for unusual activity

Stay Vigilant, Stay Informed, and Stay Safe

The best defense against tax refund scams and fraud is to stay informed and vigilant. Keep up with the latest scams and consumer alerts by checking the IRS website and other reliable sources. Don’t be afraid to question anything that seems suspicious and always protect your personal information. And remember: the earlier you can file your tax return, the better!

Survive Tax Season with UncommonGood

UncommonGood is the all-in-one platform where freelancers manage their finances, marketing, and business operations. UncommonGood is the perfect tool for surviving tax season thanks to these features:

- Calendar: Never miss a tax filing deadline again! (That’s more of your hard-earned money that you get to keep.)

- To-Do List: Assign tasks and reminders to yourself to record your business operating expenses, submit estimated tax payments, and check in with your favorite tax professional.

- Invoices & Payments: Get paid via UncommonGood so you can track your income in one place.

Sign up for a free trial and discover the UncommonGood difference today!